AI-Powered Financial Modeling

Build audit-ready financial models 10× faster with Rabyt's AI agent that generates transparent models cell-by-cell in a Cursor-like environment.

Rabyt Financial Metrics

- TAM↑$2B+Total Addressable Market

- ROI↑10×Efficiency Improvement

- TIME-TO-MODEL↓90%Reduction in Modeling Time

- AUDIT-READY✓100%Transparent Formulas

- ANALYSTS→1.2M+Potential Users

- MVP→6 WEEKSAlpha Version Timeline

- USER-TESTS↑23+Industry Interviews

- DATA-INTEGRATIONS✓ALLCompatible Data Sources

- FEATURE-COVERAGE↑85%vs. Competitors

- FOUNDER-EXPERTISE✓15+ YRSCombined Experience

Build complex financial models 10× faster

Rabyt transforms how financial analysts work by providing an AI agent that understands your data and helps build transparent, audit-ready financial models.

Enterprise-Grade Security

Rabyt will be built with the same rigorous security standards as our competitors like Hebbia, Endex, and Rogo.ai. We understand that financial data is highly sensitive and requires robust protections at every level.

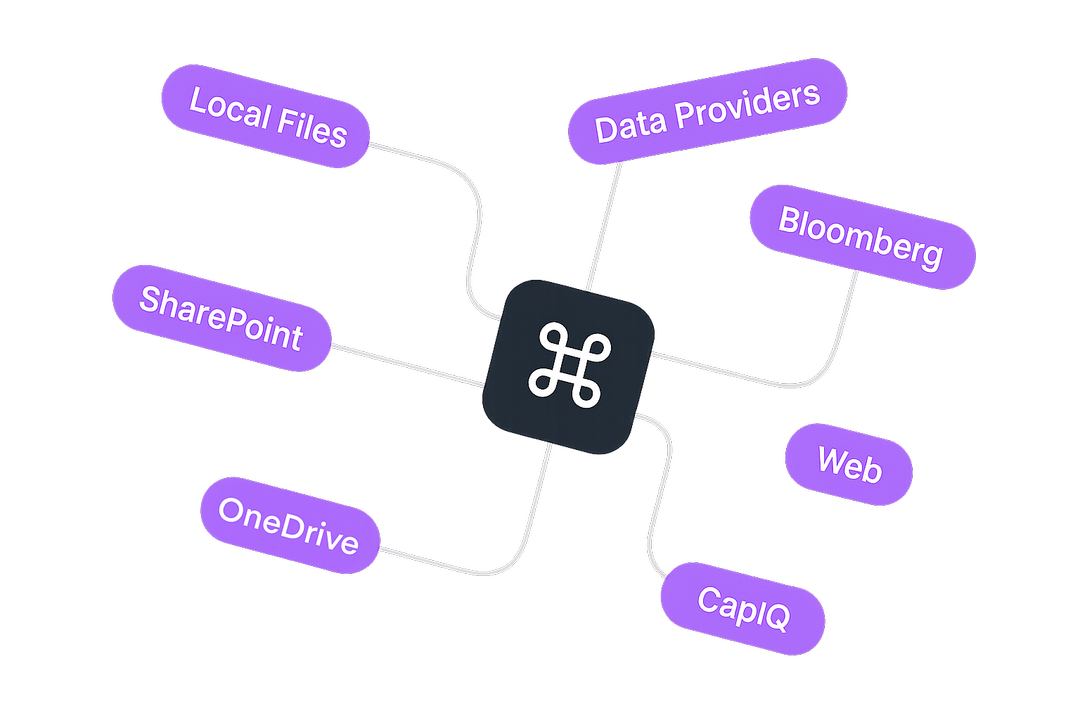

Secure Data Ingestion

Our platform will provide secure connectors to local files, OneDrive, SharePoint, and financial data providers like CapIQ and Bloomberg exports. Your sensitive financial data never leaves your secure environment without your explicit permission.

Sandboxed Execution

We prevent hallucinated formulas from corrupting your live workbooks. Every change is presented as a preview diff before you commit to it, ensuring full control over your financial models.

AI Transparency & Model Controls

Every AI-generated formula or adjustment is presented with full context and rationale. Users can review, edit, or reject suggestions before applying them, ensuring full control and audit-friendliness — without AI overreach.

SOC 2 Compliance

We're committed to achieving SOC 2 certification, ensuring our infrastructure meets rigorous security standards for enterprise deployments.

GDPR Compliance

Our platform (Post-MVP) will be designed to meet GDPR requirements, with transparent data processing, data minimization, and user rights management built-in.

FINRA Compatibility

We're building our platform with financial regulatory requirements in mind, ensuring compliance with FINRA guidelines for enterprise rollout (Post-MVP).

Long-Context Modeling

Our specialized pipelines can handle financial PDFs with 1-2M tokens through advanced retrieval and hierarchical summarization tailored to financial statements.

Advanced XBRL Parsing

We extract structured data from XBRL tags in financial documents, providing more accurate and reliable inputs for your financial models.

Data Encryption

All data is encrypted at rest and in transit using industry-standard encryption protocols to protect your sensitive financial information.

What do we envision for the Rabyt UI?

There are many approaches to financial modeling, but most remain outdated—manual, fragmented, or overly complex, making them hard to trust or scale.

Surface modeling issues before they become mistakes.

Get a taste of what Rabyt's Audit Agent can do for your models:

Rabyt AI Architecture

Our AI-powered financial modeling platform works through an integrated system of specialized components on top of a Electron.js desktop app with a FastAPI backend.

Agentic Interface

Rabyt Desktop

Agent Framework

Rabyt Desktop

Tools

Charting, Spreadsheet interaction

Financial Search Engines

Hybrid Keyword & Vector Search

Query Planning

Decomposing the Task

Context Window Management

Chat History, re-rank, metadata

Injection Agent

Entity Mapper

Sanity Check

Scaffolding Agent

Formula Composer

Accounting Logic Agent

Reasoning Agent

Scenario Engine

Narrative Agent

Presentation Agent

Audit Agent

Compliance Agent

Unified Financial Knowledge Graph

Data Lake

Structured, unstructured, semi-structured

Large Scale Content Injection

Regulatory filings, transcripts, web data

Financial Content Providers

E.g. Bloomberg Terminal, Yahoo Finance, etc.

Enterprise App Data

E.g. DealCloud, Salesforce, Sharepoint, etc.

Building the Future of Financial Modeling

Rabyt is a cursor-like environment for financial analysts who build and test complex financial models. Our AI agent contextualizes your data, then helps you build financial models cell-by-cell with transparent formulas, not black-box outputs. Users can accept or reject edits inline while our agent learns from those corrections, producing audit-ready models 10× faster with traceable logic.

Unified Data Graph

Ingests & links your raw data into a unified financial-data graph for powerful modeling.

Transparent Models

Generates models cell-by-cell with clear formulas, not black-box outputs.

Iterative Learning

Accept or reject edits inline while our agent learns from your corrections.

Join Our Vision

Transform Financial Modeling Forever. We're building the future of financial analysis with a $2B+ TAM and a clear path to revolutionizing how financial professionals work. Our team is ready to scale this vision with the right partners.